What the American Rescue Plan says about President Biden’s health care priorities – and what they mean for you

- Written by Zack Buck, Associate Professor of Law, University of Tennessee

As millions of Americans receive COVID-19 vaccines, the Affordable Care Act just got a booster shot of its own.

After 11 years[1] of existential threat and months after an argument before the Supreme Court[2], the ACA has been strengthened under President Joe Biden’s American Rescue Plan, the US$1.9 trillion economic relief package. This means greater access to health insurance at lower costs for millions of Americans.

The ARP is the most noteworthy expansion of health insurance benefits since the passage of the landmark legislation in 2010. Specifically, it contains[3] an important extension of financial assistance[4] to Americans who purchase health insurance on the ACA’s private insurance exchanges.

As a health law professor[5] who focuses on health care finance and delivery[6], I see this as a key moment to gain insight into President Biden’s preferred policy choices as he seeks to improve health care access and financing in the United States.

The original policy architecture

In addition to outlawing preexisting condition discrimination, providing the funding to expand Medicaid programs across the country, and encouraging Medicare spending reforms, the ACA constructed private marketplaces, known as exchanges[7]. People who did not receive health insurance from their jobs, or who were not part of Medicare, Medicaid, or any other public plan, could purchase highly regulated health insurance plans with the help of federal tax subsidies known as premium tax credits[8].

These tax subsidies were vital to the reforms; without them, policymakers knew that fewer people would enroll, particularly because the exchange insurance plans were unaffordable for many Americans.

As designed, these tax credits were available to Americans making between 100% and 400% of the federal poverty level[9]. In 2021, the poverty level[10] for an individual is just under $13,000 of annual income; for a family of four, it is $26,500.

For many of these Americans who qualified for tax subsidy assistance to purchase health insurance, this financial assistance was indispensable. The subsidies are robust: About 85%[11] of Americans have qualified for a subsidy on the exchange, and, of those, the average subsidy pays for about 85%[12] of the overall health insurance premium for the beneficiary.

In 2020, the average premium was $576[13], and the average subsidy was $492[14], meaning that the average beneficiary paid $84 in monthly premiums.

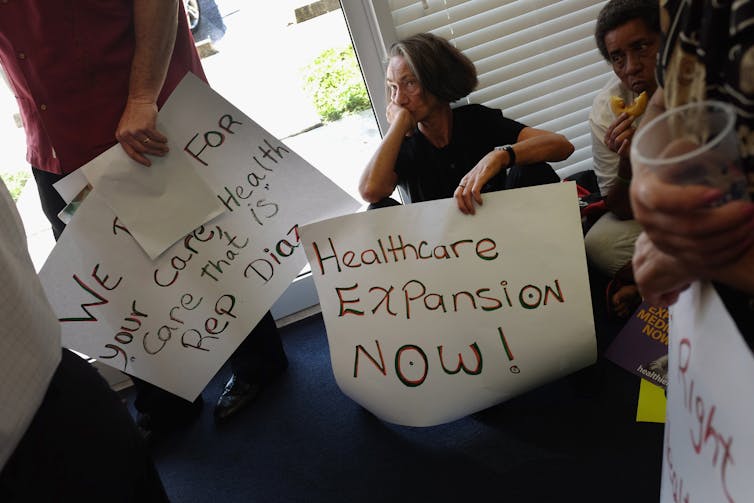

Protesters in Miami urge state officials to expand Florida’s Medicaid program.

Joe Readie/Getty Images[15]

Protesters in Miami urge state officials to expand Florida’s Medicaid program.

Joe Readie/Getty Images[15]

An unexpected problem

While the subsidy was quite generous for these income groups, many Americans with incomes just above or just below the cutoffs faced unaffordable premiums. Without federal help, individuals could face thousands of dollars in health insurance premiums per year.

One of the ACA’s main thrusts was to protect the poorest Americans, or those making less than 100% of the poverty level. As the law was written, this would happen through an expansion of Medicaid, the federal-state program that provides health care coverage to the poor.

The law contemplated that many would qualify for newly expanded Medicaid; these individuals would not need access to the new private insurance exchange. Of course, this was altered when the Supreme Court in 2012 ruled that the Medicaid expansion contemplated by the ACA could not be mandatory[16].

Following the 2012 decision, most states expanded their programs, but 12 states[17] have continued to refuse to expand their Medicaid programs, mainly because of concerns about costs. As a result, those under the federal poverty level living in those states that have not expanded Medicaid have fallen into a coverage gap[18]. They have been unable to access Medicaid coverage in their states and unable to access tax credits to purchase subsidy-assisted exchange plans.

At the other end of the income spectrum, people making more than 400% of the poverty level faced increasing premiums. This was a particular problem for many Americans nearing age 65, especially those who were independent contractors, business owners or early retirees. And as insurance premiums increased, these Americans could not depend on any subsidy cushion to assist[19], requiring either the purchase of extremely expensive health plans or the decision to go without health insurance.

President Joe Biden announces extension for enrolling for insurance through the ACA.The new rules

But the ARP broadens subsidies for every income group. Almost everyone is now eligible for credits that limit their health insurance premiums to no more than 8.5% of their household income.

Specifically, according to the Congressional Budget Office[20], people with incomes just over 400 percent of the poverty level “who are older or enrolled in family policies or in insurance rating areas with especially high premiums would experience the greatest reduction in net premiums.”

Additionally, for those lower on the income scale, the new tax credit structure grows to relieve the burden of any premium for individuals making between 100% and 150% of the poverty level (this reduces the premiums from the limit of 2.07% to 4.14% currently[21]).

These changes should make plans much more affordable for many exchange customers, better facilitating their ability to acquire health insurance. Already, more than 200,000 additional Americans[22] have signed up for plans during the current special enrollment period. And President Biden announced on March 23 that the enrollment period will be extended until Aug. 15[23].

To address the coverage gap in holdout states, the ARP bolsters funding in an attempt to sweeten the deal for Medicaid expansion. This has led to renewed consideration[24] and garnered additional support[25] for Medicaid expansion in these states.

Debate has swirled for years over whether the U.S. should switch to a single-payer system.

Justin Sullivan/Getty Images[26]

Debate has swirled for years over whether the U.S. should switch to a single-payer system.

Justin Sullivan/Getty Images[26]

The policy choice

In addition to providing tangible benefits to those buying health insurance on the private health insurance exchange, the move by President Biden illustrates his commitment to bolstering the ACA. Indeed, for his first big move on health policy, Biden is strengthening private insurance.

This is a far cry from the more dramatic reforms sought by some advocates, such as “Medicare for All[27]” proposals, or extensions to traditional Medicare, or even more moderate but still disruptive reforms like a public option. Instead of deconstructing private insurance, Biden is making it more durable.

This signals a continuation of the status quo from the Obama administration, and not a dramatic shift in how the federal government conceives of health care insurance in this country. A world in which the ACA provides more financial insulation for more Americans may be a world in which dramatic cost-controlling reforms seem less likely. And while these welcomed changes will limit the health care expenditures for which many Americans are responsible, the large-scale, endemic causes of the high cost of American health care are likely to remain in place.

[Get facts about coronavirus and the latest research. Sign up for The Conversation’s newsletter.[28]]

References

- ^ 11 years (www.nytimes.com)

- ^ argument before the Supreme Court (www.npr.org)

- ^ contains (www.nytimes.com)

- ^ important extension of financial assistance (www.hhs.gov)

- ^ health law professor (law.utk.edu)

- ^ focuses on health care finance and delivery (papers.ssrn.com)

- ^ exchanges (www.healthcare.gov)

- ^ premium tax credits (www.irs.gov)

- ^ federal poverty level (aspe.hhs.gov)

- ^ poverty level (aspe.hhs.gov)

- ^ About 85% (www.healthinsurance.org)

- ^ about 85% (www.healthinsurance.org)

- ^ $576 (www.healthinsurance.org)

- ^ $492 (www.healthinsurance.org)

- ^ Joe Readie/Getty Images (www.gettyimages.com)

- ^ could not be mandatory (www.kff.org)

- ^ 12 states (www.kff.org)

- ^ coverage gap (www.kff.org)

- ^ not depend on any subsidy cushion to assist (khn.org)

- ^ Congressional Budget Office (www.cbo.gov)

- ^ this reduces the premiums from the limit of 2.07% to 4.14% currently (www.cbo.gov)

- ^ more than 200,000 additional Americans (www.nytimes.com)

- ^ the enrollment period will be extended until Aug. 15 (www.wsj.com)

- ^ led to renewed consideration (nymag.com)

- ^ garnered additional support (www.usnews.com)

- ^ Justin Sullivan/Getty Images (www.gettyimages.com)

- ^ Medicare for All (www.nbcnews.com)

- ^ Sign up for The Conversation’s newsletter. (theconversation.com)

Authors: Zack Buck, Associate Professor of Law, University of Tennessee