Farmers – long Trump backers – bear the costs of new tariffs, restricted immigration and slashed renewable energy subsidies

- Written by Kee Hyun Park, Assistant Professor of International Political Economy, Nanyang Technological University; Institute for Humane Studies

Few political alliances in recent American history have seemed as solid as the one between Donald Trump and the country’s farmers. Through three elections, farmers stood by Trump[1] even as tariffs, trade wars and labor shortages squeezed profits.

But Trump’s second term may be different.

A new round of administration policies now cuts deeper into farmers’ livelihoods – not just squeezing profits but reshaping how farms survive – through renewed tariffs on agricultural products[2], visa restrictions on farm workers[3], reduced farm subsidies[4] and open favoritism[5] toward South American agricultural competitors.

In the past, farmers’ loyalty to Trump has overridden economics. In our study of the 2018–19 trade war between the U.S. and China, we found that farmers in Trump-voting counties kept planting soybeans[6] even though the trade war’s effects were clear: Their costs would rise and their profits would fall. Farmers in Democratic-leaning counties, by contrast, shifted acreage toward alternatives such as corn or wheat that were likely to be more profitable. For many pro-Trump farmers, political belief outweighed market logic[7] – at least in the short term.

Today, the economic effects of policies affecting farmers are broader and deeper – and the resolve that carried farmers’ support for Trump through the first trade war may no longer be enough.

Tariffs: The familiar pain returns

The revived U.S.-China trade conflict has again placed soybeans at its center. In March 2025, Beijing suspended import licenses[8] for several major U.S. soybean exporters following new U.S. tariffs on Chinese goods. Trump countered with a new round of reciprocal tariffs, broadening the list of Chinese imports hit and raising rates on already targeted goods.

An October 2025 deal promised China would buy 25 million metric tons of U.S. soybeans[9] a year, but relief has proved mostly symbolic.

Before the 2018-19 trade war, China regularly imported 30 million to 36 million metric tons of U.S. soybeans annually — more than one-third of all American soybean exports. Now, Beijing has signed long-term contracts with Brazil and Argentina[10], leaving U.S. producers with shrinking overseas demand for their crops.

Prices remain roughly 40% to 50% below pre-2018 levels, and farmers are storing record volumes of unsold soybeans[11].

In 2019, the federal government cushioned those losses with over $23 billion in bailout payments[12] to farmers. This time, Republican leaders show little appetite for another bailout[13]. Meanwhile, the U.S. Department of Agriculture’s funds for farm relief are running low[14], leaving farmers with lower prices and less support.

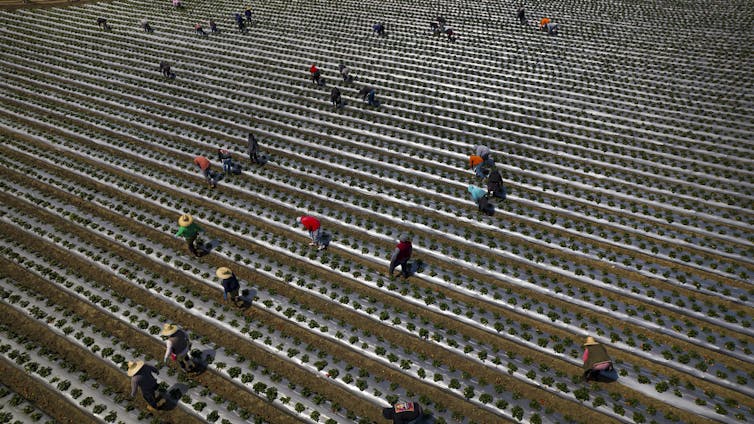

Labor: Fewer hands, higher costs

Farms are also short of workers. Roughly 42% of U.S. crop workers[16] lack legal status, according to the National Agricultural Workers Survey. Tougher immigration enforcement and slower visa processing[17] have thinned the labor pool just as production costs are surging. Hired-labor expenses rose 14.4% from 2021 to 2022 and another 15.2% the following year[18], and costs such as fertilizer[19], equipment and parts[20] climbed sharply.

Many growers are turning to the H-2A guest worker program[21] – a legal pipeline for seasonal foreign labor that has quadrupled in size over the past decade. But it is expensive: Farms must pay the adverse effect wage rate[22], a federally set pay rate that is more than twice[23] the regular federal minimum wage[24]. And farms must provide every H-2A worker with free housing and free transportation[25] to and from the U.S., as well as from their housing to the worksite. Large agribusinesses can absorb those costs; small family farms often cannot.

As exports collapsed in late September 2025, the head of the American Soybean Association wrote a public letter to the White House begging for help, saying, “We’ve had your back. We need you to have ours now[26].” The hard-line immigration policy approach that rallies rural voters[27] is also pushing smaller farms to the brink – forcing them to ask what their loyalty still buys.

Subsidies and symbolism: The Argentina shock

The question of the value of farmers’ loyalty sharpened in the fall of 2025 when the U.S. Treasury approved a $20 billion currency-swap deal with Argentina[29] – supporting the country’s president, Javier Milei, a political ally of Trump, while the country remains a direct agricultural competitor.

U.S. farmers, already frustrated by low prices and visa delays, took it as an insult. Argentina is among the world’s largest soybean exporters, and U.S. farm groups asked why the federal government would underwrite a competitor[30] while trimming support for American producers at home.

The tension deepened when Trump floated the idea of buying Argentinian beef for U.S. markets – a remark one Kansas rancher called “an absolute betrayal[31].” The plan may be economically minor, but symbolically it pierced the “America First” narrative[32] that had helped hold the farm vote together.

Solar panels can help cut energy costs for farm operations, such as dairies.

Shawn Patrick Ouellette/Portland Press Herald via Getty Images[33]

Solar panels can help cut energy costs for farm operations, such as dairies.

Shawn Patrick Ouellette/Portland Press Herald via Getty Images[33]

Clean energy: The new rural subsidy under threat

For decades, the farm vote relied on federally funded support programs[34] – crop insurance, price guarantees and disaster assistance – which account for a significant share of net farm income. Over the past five years, a quieter lifeline has emerged: renewable energy.

Wind and solar projects[35] have brought jobs, tax revenue and steady lease payments[36] to rural counties that have been losing both population and farm income for decades. Iowa now gets about 63% of its electricity from wind[37], while Texas, Oklahoma and Kansas have seen significant growth.

That momentum has stalled. In August 2025, a U.S. Treasury Department policy change[38] froze billions in rural investment[39] in renewable energy projects. Industry trackers report that prolonged uncertainty has pushed many Midwestern renewable projects into limbo[40].

For farmers, this isn’t an abstract climate debate — it’s a lost income stream[41]. Leasing land for turbines or solar panels[42] brought in tens of thousands of dollars a year and kept many family farms afloat[43].

The freeze wipes out one of the few growth engines in rural America and highlights an irony at the heart of Trump’s message: The administration that promises to protect the heartland[44] is dismantling the clean energy investments that were finally helping it diversify.

During his 2024 presidential campaign, Donald Trump promised support to U.S. farmers, alongside future EPA head Lee Zeldin.

Win McNamee/Getty Images[45]

During his 2024 presidential campaign, Donald Trump promised support to U.S. farmers, alongside future EPA head Lee Zeldin.

Win McNamee/Getty Images[45]

Politics: How deep does loyalty run?

As our research found, during the first trade war, Trump-voting counties absorbed heavy financial losses without changing course[46]. That loyalty was propped up by subsidies – and by hope. This time, neither cushion is secure.

Many farmers still share Trump’s skepticism of Washington and global elites. But shrinking federal backing, tighter labor and a competitor’s bailout cut close to home. The question now is whether cultural identity can keep outweighing material loss – or whether the second trade war will signal a deeper political shift.

No sudden collapse of rural support for Trump is likely; cultural loyalty doesn’t fade overnight. But strain is visible. Farm groups are quietly pressing for pragmatic trade policy and visa reform[47], and several Republican governors now lobby for labor flexibility rather than tougher enforcement[48].

If the first Trump trade war tested farmers’ wallets, this one tests their faith – and faith, once shaken, is far harder to restore.

References

- ^ farmers stood by Trump (investigatemidwest.org)

- ^ tariffs on agricultural products (natlawreview.com)

- ^ visa restrictions on farm workers (www.kff.org)

- ^ reduced farm subsidies (lailluminator.com)

- ^ open favoritism (abcnews.go.com)

- ^ farmers in Trump-voting counties kept planting soybeans (doi.org)

- ^ political belief outweighed market logic (theconversation.com)

- ^ Beijing suspended import licenses (www.reuters.com)

- ^ China would buy 25 million metric tons of U.S. soybeans (www.reuters.com)

- ^ long-term contracts with Brazil and Argentina (www.reuters.com)

- ^ storing record volumes of unsold soybeans (www.agriculture.com)

- ^ over $23 billion in bailout payments (www.gao.gov)

- ^ little appetite for another bailout (www.politico.com)

- ^ funds for farm relief are running low (www.govexec.com)

- ^ Visions of America/Joe Sohm/Universal Images Group via Getty Images (www.gettyimages.com)

- ^ Roughly 42% of U.S. crop workers (www.ers.usda.gov)

- ^ Tougher immigration enforcement and slower visa processing (investigatemidwest.org)

- ^ another 15.2% the following year (farmdocdaily.illinois.edu)

- ^ fertilizer (www.reuters.com)

- ^ equipment and parts (farmdocdaily.illinois.edu)

- ^ H-2A guest worker program (www.ers.usda.gov)

- ^ adverse effect wage rate (flag.dol.gov)

- ^ more than twice (flag.dol.gov)

- ^ regular federal minimum wage (www.dol.gov)

- ^ free housing and free transportation (www.dol.gov)

- ^ We need you to have ours now (www.newsweek.com)

- ^ rallies rural voters (www.washingtonpost.com)

- ^ AP Photo/Alex Brandon (newsroom.ap.org)

- ^ $20 billion currency-swap deal with Argentina (www.reuters.com)

- ^ underwrite a competitor (soygrowers.com)

- ^ an absolute betrayal (kansaspublicradio.org)

- ^ symbolically it pierced the “America First” narrative (www.washingtonpost.com)

- ^ Shawn Patrick Ouellette/Portland Press Herald via Getty Images (www.gettyimages.com)

- ^ federally funded support programs (www.ers.usda.gov)

- ^ Wind and solar projects (theconversation.com)

- ^ steady lease payments (theconversation.com)

- ^ 63% of its electricity from wind (www.eia.gov)

- ^ U.S. Treasury Department policy change (www.irs.gov)

- ^ froze billions in rural investment (www.washingtonpost.com)

- ^ many Midwestern renewable projects into limbo (www.bondbuyer.com)

- ^ it’s a lost income stream (e2.org)

- ^ Leasing land for turbines or solar panels (theconversation.com)

- ^ kept many family farms afloat (theconversation.com)

- ^ promises to protect the heartland (trumpwhitehouse.archives.gov)

- ^ Win McNamee/Getty Images (www.gettyimages.com)

- ^ absorbed heavy financial losses without changing course (doi.org)

- ^ pressing for pragmatic trade policy and visa reform (www.profarmer.com)

- ^ labor flexibility rather than tougher enforcement (www.rga.org)

Authors: Kee Hyun Park, Assistant Professor of International Political Economy, Nanyang Technological University; Institute for Humane Studies