How winning $1 billion in Mega Millions could lead to bankruptcy

- Written by Jay L. Zagorsky, Adjunct associate professor, Boston University

The U.S. Mega Millions lottery[1] is holding a drawing on Oct. 19 for a jackpot that’s swelled to US$1 billion after the 24 drawings held since the end of July failed to yield a winner.

This princely sum is drawing such attention[2] that more people are buying tickets, and even the lottery’s own projections are changing rapidly. On Oct. 17, the payout was an estimated $900 million. Two days later, just before the drawing, it hit $1 billion.

That makes it the second-largest lottery[3] grand prize the world has ever seen – and the biggest for Mega Millions. The largest ever, at $1.6 billion[4], was in 2016 in the rival Powerball game.

The odds of winning[5] are very small, or about 1 in 303 million. You are about 400 times more likely to be hit by lightning[6]. If every adult[7] in the U.S. purchased just one ticket, each with a different number, there would still be a good chance – about 7 percent – that no winner would emerge and the pot would grow even larger.

But once a winner is declared, a more interesting question arises: What happens to all that money and the lucky ticket holder? As research by myself[8] and others shows, it’s often not what you’d expect.

The jackpot for Mega Millions is the highest it has ever been.

Reuters/Brendan McDermid[9]

The jackpot for Mega Millions is the highest it has ever been.

Reuters/Brendan McDermid[9]

A smaller prize than it seems

The first thing to bear in mind is that while the billion-dollar jackpot is eye-wateringly large, the actual payout will be much less.

If someone happens to claim it in the latest drawing, the winner would not actually receive $1 billion in one big check the next day. Assuming just one person wins it, he or she can either choose a lump sum payment that amounts to barely more than half that, about $565 million, or receive $1 billion worth of annual payments that get progressively higher over 30 years[10].

After that, the taxman gets to take a big bite. If the winner comes from a state without a lottery tax like Florida or Texas and chooses a lump sum, the federal government will take[11] about $135 million of that, leaving $430 million. But if he or she is unlucky enough to live in New York City – one of only two cities that have their own tax – that dwindles to about $360 million.

That jackpot is starting to look a lot smaller, though it’s still a fair chunk of change.

Where windfalls go

The conventional wisdom is that winning the lottery will change your life. While that’s probably always true, research suggests not always in the way you might hope.

Economists Guido Imbens and Bruce Sacerdote and statistician Donald Rubin showed in a 2001 paper[12] that people tend to spend unexpected windfalls. Looking at lottery winners approximately 10 years after winning showed they saved just 16 cents of every dollar won.

In my own research, I found that the average person in their 20s, 30s and 40s who was given an inheritance or large financial gift[13] quickly lost half the money through spending or poor investments.

And other studies have found[14] that winning the lottery generally didn’t help financially distressed people escape their troubles and instead only postponed the inevitable bankruptcy. One found[15] that a third of lottery winners go bankrupt.

It’s easy to spend too much money on a Ferrari once you win the lottery.

Reuters/Henry Nicholls[16]

It’s easy to spend too much money on a Ferrari once you win the lottery.

Reuters/Henry Nicholls[16]

It’s not easy to blow it all

So how exactly could a lottery winner blow through hundreds of millions of dollars so quickly? It’s not easy.

Demographic research on lottery players’ characteristics shows that lottery playing peaks[17] when people are in the 30-39 age range and actually falls as people get older. And the average person in the U.S. lives to age 79[18].

So that means, assuming the winner is in her 30s, she would have about 45 years or so to spend the lump after-tax sum of, let’s say, $400 million. That means she would have to spend a bit less than $9 million a year or roughly $25,000 per day to burn through it all – even more when you factor in interest accrued while it sits in the bank.

In addition, really blowing it all means the winner has no assets to show for it. If he uses the money to buy luxury homes, Banksy paintings[19] and Ferraris and Aston Martins, his net worth wouldn’t actually change and he’d be able to retire with his wealth intact – assuming the investments kept their value or rose.

Blowing through the money, which leads to bankruptcy and low savings rates, means the winner has nothing to show for his spending besides a good time.

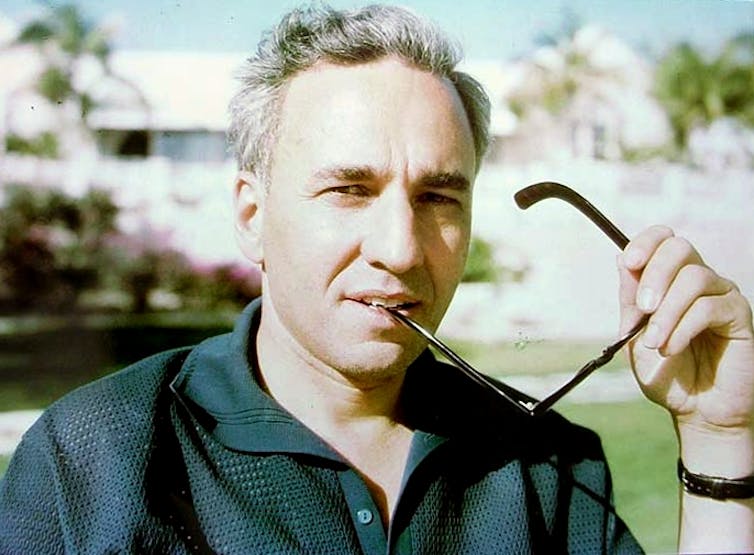

Huntington Hartford inherited millions. He died in poverty.

Diane Hartford/Wikimedia Commons, CC BY[20][21]

Huntington Hartford inherited millions. He died in poverty.

Diane Hartford/Wikimedia Commons, CC BY[20][21]

Riches to rags

And that’s basically what a man named Huntington Hartford did.

Hartford, who lived from 1911 to 2008, was the heir to the Great Atlantic & Pacific Tea Company[22] fortune. This company, which started just before the Civil War, is better known as the A&P supermarket chain. A&P was the first U.S. coast-to-coast food store, and from World War I to the 1960s was what Walmart[23] is for today’s American shoppers.

Hartford inherited approximately $90 million[24] when he was 12. Adjusting for inflation[25] means he was given over $1.3 billion as a child, after taxes. Yet Huntington declared bankruptcy[26] in New York in 1992, approximately 70 years after being handed one of the largest fortunes in the world.

Hartford had the reverse Midas touch. He lost millions buying real estate, creating an art museum and sponsoring theaters and shows. He combined poor business skills with an exceptionally lavish lifestyle. After declaring bankruptcy, he lived as a recluse with a daughter in the Bahamas until he died.

May the odds be in your favor

Hartford’s life story, coupled with academic research, shows that coming into a windfall of cash doesn’t always have a happy ending. Squandering that money is easier than it seems.

If you are planning on playing, I wish you good luck. If you are planning on winning, I wish you even more luck.

Nevertheless, one key lesson, whether you play or not, is that when you get a windfall or win the lottery, plan ahead and resist the all-too-human temptation to spend all the money.

This is an updated version of an article originally published[27] on Jan. 12, 2016.

References

- ^ Mega Millions lottery (www.megamillions.com)

- ^ princely sum is drawing such attention (www.cbsnews.com)

- ^ second-largest lottery (www.cnbc.com)

- ^ $1.6 billion (www.today.com)

- ^ odds of winning (www.megamillions.com)

- ^ 400 times more likely to be hit by lightning (news.nationalgeographic.com)

- ^ every adult (www.census.gov)

- ^ myself (doi.org)

- ^ Reuters/Brendan McDermid (pictures.reuters.com)

- ^ 30 years (www.megamillions.com)

- ^ will take (www.usamega.com)

- ^ showed in a 2001 paper (doi.org)

- ^ given an inheritance or large financial gift (doi.org)

- ^ have found (doi.org)

- ^ One found (fortune.com)

- ^ Reuters/Henry Nicholls (pictures.reuters.com)

- ^ lottery playing peaks (link.springer.com)

- ^ lives to age 79 (www.usatoday.com)

- ^ Banksy paintings (www.vulture.com)

- ^ Diane Hartford/Wikimedia Commons (en.wikipedia.org)

- ^ CC BY (creativecommons.org)

- ^ the Great Atlantic & Pacific Tea Company (www.groceteria.com)

- ^ Walmart (www.walmart.com)

- ^ approximately $90 million (www.telegraph.co.uk)

- ^ Adjusting for inflation (businessmacroeconomics.com)

- ^ declared bankruptcy (www.nytimes.com)

- ^ article originally published (theconversation.com)

Authors: Jay L. Zagorsky, Adjunct associate professor, Boston University

Read more http://theconversation.com/how-winning-1-billion-in-mega-millions-could-lead-to-bankruptcy-105275