Venezuela's 'desperate' currency devaluation won't save its economy from collapse

- Written by Benjamin J. Cohen, Professor of International Political Economy, University of California, Santa Barbara

Venezuela recently announced[1] one of the most dramatic currency reforms in history in a move that essentially devalues the bolivar by about 95 percent.

Its ironically named bolivar fuerte, meaning “strong,” first introduced 10 years ago, will be replaced by a new “sovereign” version at a conversion rate of 100,000 to one sovereign. At the same time the government’s official exchange rate will be bumped from 285,000 bolivars per dollar to 6 million.

In my experience as a scholar of currencies[2], I have rarely seen a devaluation this large. In effect, Venezuela has confessed that its money has become virtually worthless and it is time to start over.

But is a new start even possible?

Hyperinflation on steroids

The reason for the reform is clear: inflation.

In recent years, price increases in Venezuela have accelerated exponentially and have long since entered the realm of hyperinflation, which is like inflation on steroids. Almost all countries experience some inflation but rarely at a rate higher than low double digits. Hyperinflation is when the rate surpasses 50 percent or more and begins to accelerate uncontrollably to triple digits and beyond.

In today’s Venezuela, domestic prices are rising[3] at an annualized rate of 108,000 percent. And economists at the International Monetary Fund estimate[4] that by the end of the year the rate could top 1 million percent – imagine the price of milk tripling every minute.

For families on fixed incomes, the effect of this is devastating. Money that once sufficed to put a full meal on the table suddenly cannot even buy a loaf of bread. Household essentials that were once easily affordable require wheelbarrows of cash.

That’s why I believe these are the desperate acts of a harried government rapidly running out of options.

Wads or even backpacks of cash were needed to buy life’s basic necessities.

Reuters/Marco Bello[5]

Wads or even backpacks of cash were needed to buy life’s basic necessities.

Reuters/Marco Bello[5]

Odds of success

Venezuela is hardly the first country to respond to out-of-control inflation with a currency redenomination. Many other nations[6] over the years have found themselves in the same bind.

In one decade, from the mid-1980s to the mid-1990s, neighboring Brazil burned[7] its way through no fewer than four currencies, from the cruzeiro to the cruzado to the cruzado novo to the cruzeiro real, each time lopping off three zeros. During the same period, Argentina did the same[8]. And more recently, in the first decade of the new millennium, Zimbabwe repeated the agony[9], lopping off six and later nine zeros as one new dollar followed another.

Regrettably, redenomination on its own can do little to rein in inflation. Mainly, all it does is make life easier for ordinary citizens for a while.

In Venezuela, a cup of coffee that last week cost as much as two million bolivars will now sell for a mere 20 bolivars. Venezuelans will no longer need a calculator and a backpack or two of cash when they go out to buy groceries. Prices will descend from the stratosphere.

But the benefit will be short-lived if nothing else is done to slow inflation. If prices in the local café or produce market continue to rise, purchasing power will again be eaten away. Prices will return to the stratosphere.

A protester holds a sign that reads: ‘Maduro gives oil to Cuba and people die of hunger. Enough. Country do not give up.’

Reuters/Marco Bello[10]

A protester holds a sign that reads: ‘Maduro gives oil to Cuba and people die of hunger. Enough. Country do not give up.’

Reuters/Marco Bello[10]

What devaluation is supposed to do

The key element of a currency reform is devaluation, which in principle is meant to stimulate domestic economic growth.

In the conventional textbook model, a devaluation simultaneously lowers the foreign price of exports and raises the domestic price of imports, hence expanding demand for domestic exportables and import substitutes. In other words, foreigners buy more of a country’s goods because they’re suddenly cheaper. At the same time, foreign goods become more expensive, encouraging locals to buy more domestic substitutes. The greater production that results, in turn, would then be expected to ease inflationary pressures.

But textbook models, as any student of economics quickly learns, are simple – if not simplistic – affairs that rely on a lot of hidden assumptions that may turn out to be misleading. In the real world, complications are everywhere.

In Venezuela’s case, 98 percent of export revenues[11] are derived from oil, whose price is set in world markets in dollars, not locally in bolivars. Devaluation of the bolivar will not change the price paid for Venezuelan crude.

This is a problem faced by many developing nations that rely extensively on commodity exports, including Brazil and Zimbabwe. Their lack of control over world market prices is ignored in standard textbook models.

Likewise, in an economy like Venezuela’s, which has become so specialized in terms of what it produces, there’s little domestic capacity to manufacture goods that can substitute easily for imports, regardless of their price. Venezuelans cannot suddenly start producing the vehicles or medical equipment or heavy machinery that in recent decades have been purchased abroad. That is another complication unaccounted for in conventional models.

Worst of all, devaluation may actually exacerbate the very problem it was meant to ease – namely, inflation. The more an economy relies on imports – as Venezuela does – the more the rising prices of imports will add to the cost of living, thus reinforcing the expectation among citizens that inflation will continue to accelerate, driving up wages and prices even more.

Venezuelans walk past closed stores in Caracas.

Reuters/Carlos Garcia Rawlins[12]

Venezuelans walk past closed stores in Caracas.

Reuters/Carlos Garcia Rawlins[12]

Misery loves company

Venezuela is not alone in its misery.

Economic[13] history[14] is littered[15] with examples[16] of nations that have found themselves enmeshed in a vicious circle of inflation leading to devaluation leading to further inflation, and so on.

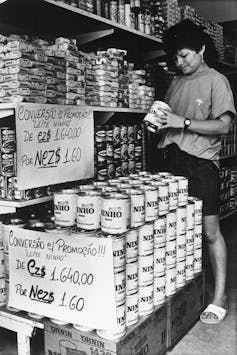

Brazil also has a long history of hyperinflation and currency devaluation.

AP Photo/Altamiro Nunes[17]

Brazil also has a long history of hyperinflation and currency devaluation.

AP Photo/Altamiro Nunes[17]

This happened to many European countries, especially Britain and Italy[18], following the oil crisis of 1973[19], when petroleum prices quadrupled. It happened to Brazil along with many other Latin American nations during the region’s “decade of lost growth” in the 1980s.

And it is happening today to Turkey[20], where the Turkish lira has lost 40 percent of its value since January and inflation is rapidly accelerating.

To alleviate Venezuela’s inflationary spiral – and Turkey’s – it will be necessary to go to the source, which is excessive spending by the government funded by printing more money. In reality, it does not matter how the currency is denominated or how often it is devalued if the central bank keeps the printing press running night and day to satisfy fiscal appetites.

A saner monetary policy will not solve all of Venezuela’s economic and political problems, but it is the place to start. Without a cap on the financing of public debt, the vicious circle of inflation cum devaluation will go on without end.

References

- ^ recently announced (www.bloomberg.com)

- ^ scholar of currencies (scholar.google.com)

- ^ are rising (www.bloomberg.com)

- ^ estimate (www.bloomberg.com)

- ^ Reuters/Marco Bello (pictures.reuters.com)

- ^ Many other nations (www.nytimes.com)

- ^ burned (www-personal.umich.edu)

- ^ did the same (economics.rabobank.com)

- ^ repeated the agony (www.forbes.com)

- ^ Reuters/Marco Bello (pictures.reuters.com)

- ^ 98 percent of export revenues (www.forbes.com)

- ^ Reuters/Carlos Garcia Rawlins (pictures.reuters.com)

- ^ Economic (books.google.com)

- ^ history (www.cambridge.org)

- ^ littered (www.tandfonline.com)

- ^ examples (www.taylorfrancis.com)

- ^ AP Photo/Altamiro Nunes (www.apimages.com)

- ^ Italy (onlinelibrary.wiley.com)

- ^ oil crisis of 1973 (history.state.gov)

- ^ happening today to Turkey (www.reuters.com)

Authors: Benjamin J. Cohen, Professor of International Political Economy, University of California, Santa Barbara