"Own the Unownable:" Mintus gives investors a chance to buy shares and invest in contemporary works, from Warhol to Condo

- Written by PR Newswire Asia - Metro Digital RSS

Mintus, the new online, art investment platform offers a new way to buy shares and invest in exceptional contemporary art opening up the annual $65bn art market

The first artworks available are iconic paintings by Andy Warhol and George Condo, with more pieces by established and emerging artists to follow

Discover more: www.mintus.com[1]

LONDON, April 21, 2022 /PRNewswire/ -- Mintus, a new, art investment platform that offers investors the opportunity to invest in high-value modern and contemporary art, launches today. Investors will be able to buy shares in a UK company which directly owns and manages the artwork. Paintings by Andy Warhol and George Condo are the first two works to be presented by Mintus, which is authorised and regulated by the Financial Conduct Authority, and the first platform of its kind in the UK. Over $200 million worth of paintings will be on offer to Mintus investors over the course of 2022, both individually and through curated portfolios of art.

Mintus: The Outcast, George Condo, 2018, iconic portraiture with the imposing scale of his most desirable works.

Mintus: The Outcast, George Condo, 2018, iconic portraiture with the imposing scale of his most desirable works.

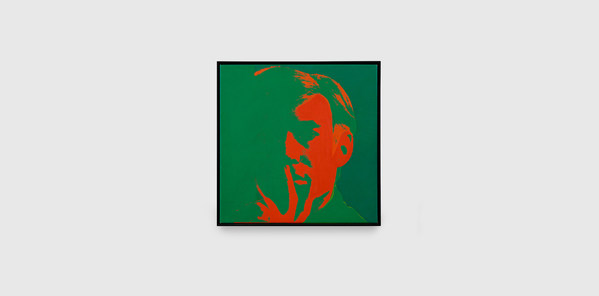

Andy Warhol's 1966 Self-Portrait and George Condo's 2018 The Outcast. New online art investment platform, Mintus, offers the chance to buy shares and invest in iconic and contemporary high-value art.

Andy Warhol's 1966 Self-Portrait and George Condo's 2018 The Outcast. New online art investment platform, Mintus, offers the chance to buy shares and invest in iconic and contemporary high-value art.

The first outstanding painting on the Mintus platform will be an Andy Warhol Self-Portrait from 1966, priced at USD $5 million and valued last month at $6.8 million by an independent, leading appraiser. The other painting is George Condo's The Outcast from 2018, priced at USD $2.775 million and valued last month at USD $3 million. Both paintings are exceptional examples of each artist's quintessential styles.

Warhol's Self-Portrait has been held in a private collection since 1991 and was last exhibited in 2003. In making the work publicly available for the first time in 31 years Mintus is enabling those looking for alternative ways to invest their money the chance to own shares and invest in an iconic artwork by the legendary pop-artist.

George Condo is one of the market's most sought after artists, deeply inspired and influenced by Pablo Picasso. He brings his figures and compositions to life through originality and wit. The visually arresting composition of The Outcast provides a unique opportunity for investors to own shares and invest in a striking work by Condo.

Brett Gorvy, Mintus' Advisory Board Member and the Chief Curator, said:

"Andy Warhol and George Condo are among the most desirable and sought-after contemporary artists to collect today. Their markets are very international and both artists are currently experiencing new popular heights as a result of major museum retrospectives and record prices achieved at auction."

Previously, accessing high-value, iconic art has predominantly been limited to selected individuals and institutions. Mintus, through its state-of-the-art, online investment platform, is now making this viable for all qualifying investors.

Contemporary art has seen an annual return of 14% over the last 25 years versus 9.5% from the S&P 500. Similarly, the 411 works by Andy Warhol that appeared at auction multiple times between 2003 and 2017 achieved an average compound annual growth rate of 14.2%.

Enabling shared ownership of art through holding shares in a company which purchases it, known as "fractionalisation," comes as people are increasingly investing in the shared economy, a trend that will shape financial growth over the next decade and beyond.

Nicky Clark, Managing Director at Mintus' Fine Art Division, said:

"Fractional ownership of art is opening up the industry by allowing investors to own a piece of the art market. Over recent years we've seen investors increasingly seek alternative investment strategies to generate risk adjusted returns. We're excited to provide them with a new way to access a passion-fuelled asset class."

Notes to Editors

Any art selected by experts and offered for shared ownership by Mintus, will be subject to independent verification and valuation. Artworks will be kept in a secure and specialist art storage facility. Qualifying investors include certified high net worth investors and self-certified sophisticated investors. Investors can certify as part of the sign-up process.

Mintus will actively manage the art investments until they are ultimately sold to enable investors to exit the investment.

Mintus has experienced individuals from investment management, technology, and the art businesses across the management team, Leadership Board and Advisory Board:

- Maarten Slendebroek, Chairman of Mintus and Member of the Board. He is the current Chairman of Robeco, the leading European ESG manager. Prior to this role he was CEO at Jupiter Fund Management from 2014 until 2019.

- Tamer Ozmen, Founder and Chief Executive of Mintus. He was a senior executive at Microsoft running its UK Services, and previously was on the team that started, launched and floated Priceline.com (now Bookings Holding Inc).

- Nicky Clark, Managing Director of Mintus' Fine Art Division. He was previously Business Director for Sotheby's Contemporary Art Department in New York. He worked on a variety of auctions including the 2019 $50m sales of Francis Bacon's Study for a Head, and Mark Rothko's Untitled.

- Brett Gorvy, Mintus Advisory Board Member and Mintus' Chief Curator. Brett is a Managing Partner at LGDR, one of the world's leading contemporary art galleries and creative collaborations, he was an early pioneer of the contemporary art boom as Chairman and International Head of Post War and Contemporary Art at Christie's.

Board Members also include: Chris Kaladeen, Head of Rothschild & Co's insurance, and investment management banking business; and Daglar Cizmeci, who is an Executive Chairman of an augmented reality and metaverse company. The Advisory Board also includes Tad Smith, former President and CEO of Sotheby's, former CEO of Madison Square Garden.

Full details of the investment and risks are included in the investment documents available to all qualifying investors who successfully complete the sign-up process with Mintus. Investors' attention is drawn to the following key risks:

- Liquidity. Shares held by investors are not traded on a recognised investment exchange. Investments are long-term. Mintus may allow secondary transactions in shares through its website in the future.

- Risk of Loss. All investments in shares involve a high degree of risk and compensation for loss of investment is not available.

- Lack of Diversification. Shares held by investors represent interests in a specific, pre-identified artwork and the past performance of the art market, a particular artist's work, or a given artwork is not a reliable indicator of its future performance.

Mintus Trading Limited is Limited is authorised and regulated by the Financial Conduct Authority under firm reference number 942522.

References

- ^ www.mintus.com (www.mintus.com)

Authors: PR Newswire Asia - Metro Digital RSS

Read more https://www.prnasia.com/story/archive/3726084_AE26084_0